How to Talk to Kids During Tough Financial Times

An article about how and why to talk about money as a family even when financial times are tough.

Part of being a caregiver includes protecting your child. You protect them when you hold their hand across a busy street or when they’re standing too close to a fire. You might even protect them from learning about certain topics too early.

When families are going through financial strain, it’s natural to want to hide your struggles. However, children are more aware of their parents’ stress and emotions than we might realize.

Conversations about money don’t have to be scary. You can talk with children about money in ways that are age-appropriate, reassuring, and that help them build a strong financial foundation.

Consider these strategies:

Keep It Simple

Money is a part of life. Introduce the concept of money in your everyday conversations.

People need money to buy things they need and want, like food and clothes.

We make choices on how we spend our money and what is best for our family. Every family is different.

Many families experience financial strain. If this is the case for your family, you can help explain this to children without overwhelming them with details. You can ease children’s fears by being calm and direct:

We can get help. Everyone gets help in some way at some point.

We have a plan for [spending less money/getting help/making changes].

We will get through this together.

You’re safe and will have what you need.

Get Kids Involved

Kids can feel empowered when they’re part of family decision-making. This can look like showing children two options for snacks at the grocery store and letting them choose one. It could be inviting your child to buy a birthday card or make one at home. Have a conversation about different reasons to choose one over the other. We could buy a card or make one at home. If we make one at home, you can draw Grandpa a striped cat. He loves striped cats! We’ll also save three dollars. What do you think we should do?

Make Plans

Show children the value of thinking ahead. Understanding how to make a plan leads to understanding the value of making a budget—a financial plan.

Begin with basic plans that children are familiar with. You can chat with children when you make a meal plan, or plan for the foods you’ll cook in the week ahead. You can also talk with them about the plans for your weekend, what to do to pack for a trip, or a plan for a special occasion or event.

Model Flexibility and Resourcefulness

You can prepare children to handle life’s unexpected twists and turns — including financial ones. When things don’t go according to plan, talk through making a new one. Flexibility and resourcefulness are life skills that benefit children in their financial lives and beyond.

We don’t have wrapping paper for your aunt’s birthday present. Instead of buying some, we can use some of your art projects to wrap her present. That will be extra special.

Special Thanks

- Sam Renick, SammyRabbit.com | Kids, Money, Education, and More

- Meghan Rabuse, Family Finance Mom

- Revere Joyce, Early Literacy Outreach Associate, Youth and Family Services

You’re Doing Great! Financial Education for Families

An article about how to stay strong and connected as a family during tough financial times.

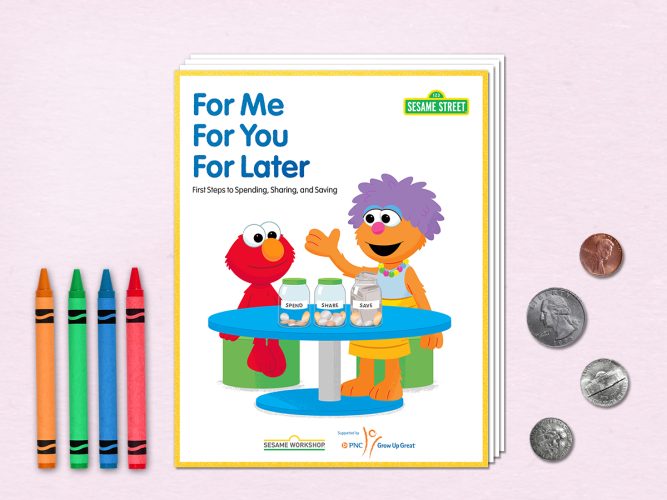

For Me, For You, For Later: Family Spending, Sharing, and Saving

A guide with resources, activities, and tips on how and why to start children’s financial education early and how to talk to children during tough financial times.

Making a Spending Plan Together

Watch Cookie Monster learn about making a plan.

Elmo’s Spend, Share, and Save Jars

Watch Elmo and Abby learn financial education basics.

Wants and Needs with Bert and Ernie: Financial Education for Kids

Watch Bert help Ernie learn the difference between wants and needs.

For Me, For You, For Later: First Steps to Spending, Sharing, and Saving—Educator Guide

A guide with resources, activities, and tips for educators on bringing financial literacy into the classroom.