Guest Post: Helping your child’s money skills grow

Learn ways to start your children’s financial futures off strong

By Kathleen Kraninger, Director, U.S. Consumer Financial Protection Bureau

Whether or not you’re teaching your children about money and finances on purpose, they’re absorbing everything you do and say. For instance, when you shop for a bargain, splurge on a treat, or plan a special occasion, you’re showing children how you think about money.

Research shows that attitudes, skills, and habits around money develop early. Children younger than five can’t grasp abstract financial concepts, but they can still develop fundamental skills they’ll need as adults: patience, planning ahead, prioritizing, distinguishing between needs and wants, counting and sorting, sticking to a task or activity, and keeping important things safe.

Even if you don’t feel like a “money expert,” you can help children build these basic skills that will serve them in many ways over a lifetime. You can even do this during everyday routines such as:

- Sharing stories. To build problem-solving, flexible thinking, and awareness of needs versus wants, notice when the characters didn’t get what they wanted at first. Ask children what they might do if that happened to them.

- Grocery shopping. Ask children to help you make shopping lists so they notice how you plan ahead for what your family needs. Then they can help you cross off the items when you find them in the store.

- Playing games. Simple games such as Musical Chairs or Simon Says can help children focus and make quick decisions. Guessing games like 20 Questions or I Spy can help children exercise their memories and think critically and creatively.

Many parents and caregivers believe that a healthy relationship with money and finances can help children’s future dreams come true. Resources like Money as You Grow from the U.S. Consumer Financial Protection Bureau (English | Spanish) can support you in building this relationship, with activities and conversation starters that pave the way to wise money management in adulthood!

How to Talk to Kids During Tough Financial Times

An article about how and why to talk about money as a family even when financial times are tough.

You’re Doing Great! Financial Education for Families

An article about how to stay strong and connected as a family during tough financial times.

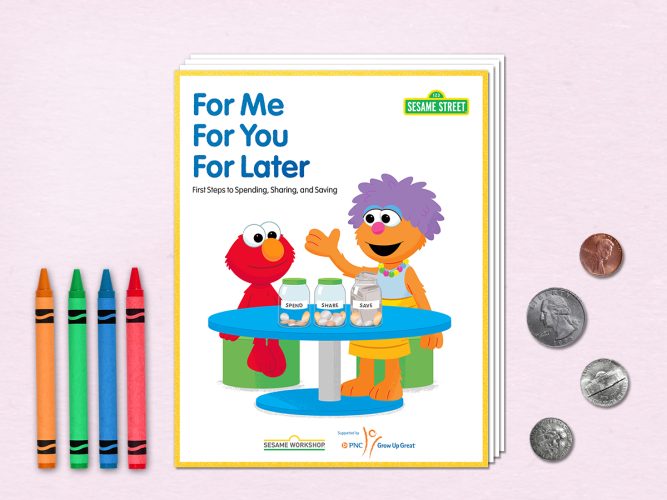

For Me, For You, For Later: Family Spending, Sharing, and Saving

A guide with resources, activities, and tips on how and why to start children’s financial education early and how to talk to children during tough financial times.

Making a Spending Plan Together

Watch Cookie Monster learn about making a plan.

Elmo’s Spend, Share, and Save Jars

Watch Elmo and Abby learn financial education basics.

Wants and Needs with Bert and Ernie: Financial Education for Kids

Watch Bert help Ernie learn the difference between wants and needs.

For Me, For You, For Later: First Steps to Spending, Sharing, and Saving—Educator Guide

A guide with resources, activities, and tips for educators on bringing financial literacy into the classroom.